How does it feel to revamp your DIY investment portfolio with a financial planner?

There are many parts to personal finance, but the one I think about all the time is investing.

It wasn’t always like this. At the beginning of my journey, I was more about saving — trying to “hack” things like credit card benefits and loyalty points — to try save money. You could say I’ve reached financial stability, so saving RM 10 on a meal won’t make an impact anymore — but figuring out how I can get 1% more returns will.

Roughly eight months ago, I started on a financial planning program with a team of licensed financial planners. We’d already covered some other parts of personal finance (e.g. cashflow, insurance, estate planning), but the one session I was really waiting for was: Investments.

We finally did it last month. My advisers reviewed all my investments with me, and proposed an action plan. It’s the most major change to my investment portfolio since I started investing, so I wanted to document it here.

Contents

A Quick Recap of My “Before”

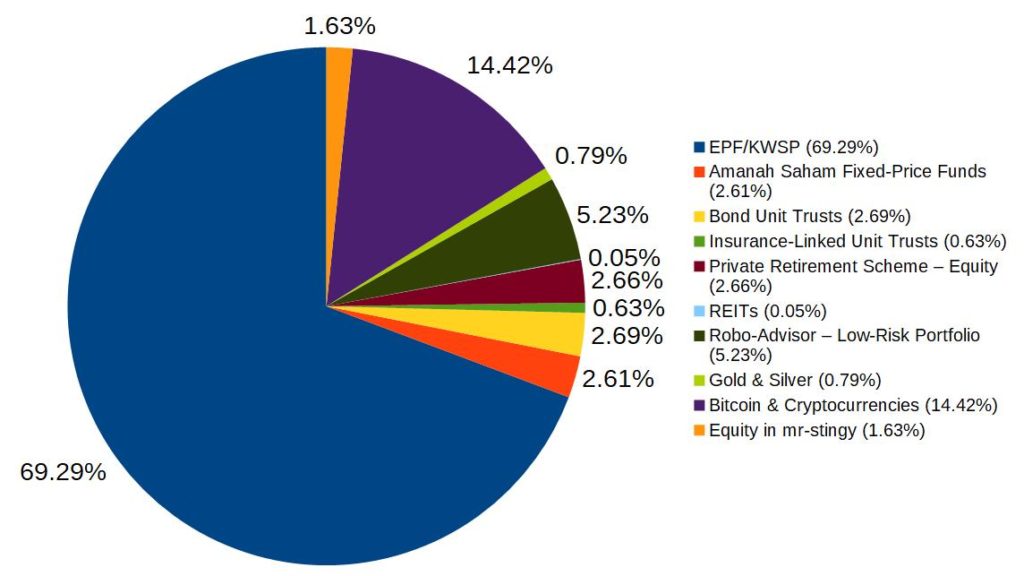

Let’s start with a recap of my investment portfolio from July 2020.

My Investment Portfolio — July 2020

I considered this an 80% safe, 20% risky portfolio. The 80% safe portion consisted mostly of: EPF retirement funds, a low-risk robo-advisor portfolio, Amanah Saham and bond unit trusts.

Meanwhile, the 20% high-risk-high-return portion consisted of: cryptocurrencies, an equity Private Retirement Scheme (PRS), equity in my company (mr-stingy LLP), and precious metals.

Rationale: With the majority of funds in safe assets, I was hoping the riskier stuff (e.g. Bitcoin) would bring me high returns. That was my “barbell” way of balancing risk and reward.

I’d built my entire portfolio without professional advice. It was DIY via my own reading and beliefs about investing. I was proud of it, like how a father thinks his imperfect son is perfect.

Where I Am At In Life

Before I go on, I wanted to share my personal circumstances. Just so you understand which stage of life I’m at and where I’m coming from.

I’m 37 this year; based in Kuala Lumpur, Malaysia. I work a full-time job for 45-50 hours/week, plus spend another ~12 hours on this blog. The only financial commitment I currently have is my home loan. (I paid off my student loan before I turned 32.) I’m blessed enough to not have any other expensive health or family-related commitments.

I don’t consider myself a great success in any particular area of life, but rather I take pride in maintaining balance.

My wife has a good full-time income too. Planning for kids in the near future. We’re financially stable, but far from financial independence or early retirement.

Getting Down to Business

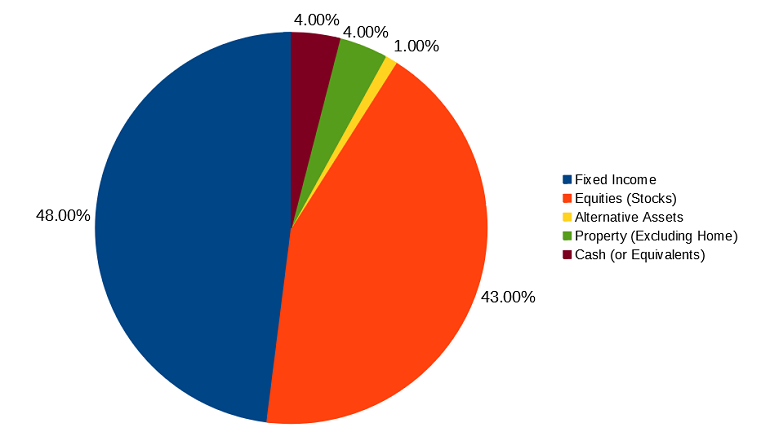

The first thing my advisers (let’s call them “CS”) made me understand, was they viewed my portfolio in a different way. Here’s my investment portfolio through the lens of different asset classes:

My Investment Portfolio — May 2021

- This is purely investments, so it doesn’t include emergency savings or the value of my home.

- Since it excludes my home, I was initially surprised to see 4% of my portfolio in property. This actually comes from the EPF, who invest in 50% Fixed Income, 40% Equities, 5% Property and 5% Cash. As part of their review, CS had broken down my EPF holdings into the asset classes above.

- If you think about it from convenience + cost factors, the EPF is actually really cool. Without lifting a finger, you already get a nicely-balanced portfolio.

- I’ve excluded the Bitcoin and crypto portion. More on that later.

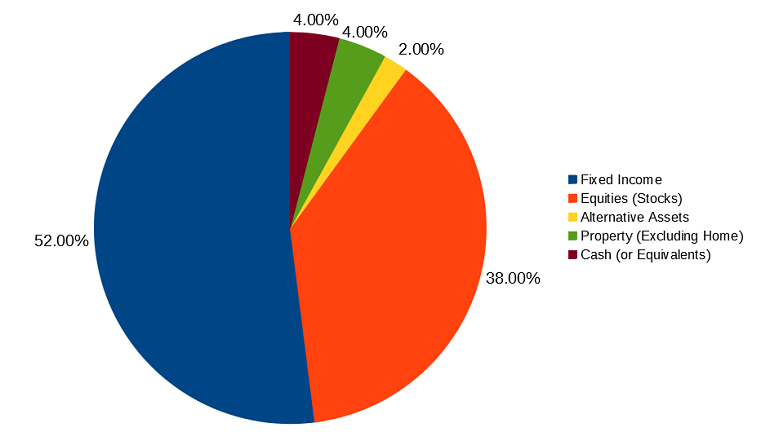

Meanwhile, CS recommended me the below:

Recommended Investment Portfolio — May 2021

- My risk profile is “Moderately Aggressive.”

- Investing is a very personal thing. CS considered multiple factors like my age, risk appetite and income before they gave me their recommendation. Your recommended portfolio might be very different to mine.

Comparing my existing portfolio vs the recommended one, it was clear I had a lot to change. “Why so much bonds?!”

A Different Point of View

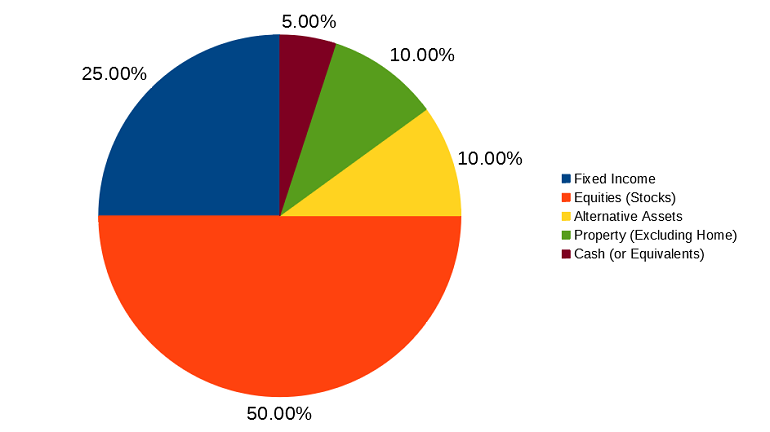

Here’s what CS suggested I do:

CS’ Recommended Actions

- Sell all my underperfoming bond unit trusts.

- Top up my emergency savings to 6 months of expenses. Maintain 3 months expenses in my flexi-home loan, and invest another 3 months in a bespoke iFAST Income Portfolio.

- Switch my Robo-advisor (StashAway) portfolio from the 6.5% Risk Index to the 22% one.

- Start monthly investments into:

- 70% Equities, 30% Bonds iFAST Managed Portfolio

- 67% Equities, 33% Bonds Akru Robo-advisor

Taking a Step Back to Process

Me being me, I had some additional angles to consider:

- Initially, CS suggested rebalancing my oversized crypto portfolio — sell some crypto to buy more equities. Even though I decided not to, CS still reviewed my overall crypto portfolio. They’re (somewhat) relieved most of my holdings are in Bitcoin, and not sh!tcoins.

- Likewise, CS suggested moving some of my virgin EPF funds into higher-performing assets. Similarly, I said no. This is more emotional than anything, but I think I’ll find a sense of joy when I’m old someday and withdraw the money — tweeting to my remaining 55 followers: “This is what compounding can do after 32 years.”

- I’m still figuring out how much I want to invest in the monthly investment plans. It’ll likely be: 8% of my salary into the Managed Portfolio, 8% into the Robo-advisor and 2% into Bitcoin.

- At face value, the Managed Portfolio fees seem expensive (up to 1.5% per year), so I’ll be watching its performance very closely.

This is what things will look like after rebalancing in June 2021:

A Note About Crypto

I’ve removed the Bitcoin & crypto portion from my portfolio discussion as it would skew things otherwise. To be clear, I view crypto as a supplementary portfolio now, which I’ll manage separately. Even if it goes to zero (super-low likelihood IMHO), it won’t affect my life plans one bit.

Meanwhile, if it continues to outperform, I’ll be able to accelerate all my life goals, and buy some nice things for my family. Over the last five years of crypto investing, I have roughly an overall 357% gain.

How to get 357% gains over five years? The bulk of my gains have been from buying Bitcoin and Ethereum, then holding for the long term. I’ve dabbled in a lot of altcoins, but either I make just a little, or I crash and burn. I probably wouldn’t make a very good day trader.

Closing Thoughts: What I’ve Learnt About Investing

Focus. I used to wanna tightly control every aspect of my money. Now that I’m older, I realize I’m running out of time. To leverage my efforts, it’s often better to get professional help. Yes this means I’ll have to pay some fees, but expertise is valuable.

Find an adviser you’re comfortable with. Don’t know if I’m viewed as a difficult client, but I have tons of granular questions going into every session. Because investing is such a personal thing, it’s important to find someone who really listens and empathizes with you.

Admit what you suck at and cut your losses. When I started investing many years ago, I DIY-ed into FSMOne. I thought I could pick good unit trusts — plus it was the cheapest, simplest way to get started. Unfortunately, I’ve made roughly only 2% per year. That’s horrible. I could have just snoozed my money into the EPF and done much better.

This isn’t a diss on FSMOne or unit trusts.

It’s about understanding strengths and weaknesses. I have a terrible track record. Plus reading fund fact sheets doesn’t spark joy like when I was 25 anymore.

Meanwhile, I’ve done okay as a crypto investor. And looking at the amount of innovation happening in the crypto space, and how it fits into my interests and capabilities — I’ve decided it’s where I want to spend the bulk of my future investing decisions.

As for everything else, well that’s what my financial planner is for.

Are you heavily in debt and need help? Get connected to a licensed financial planner.

MyPF Story is a series focusing on personal stories by licensed financial planners and Malaysians. If you have a story you would like to share, get in touch with us so we can document it.

Leave A Comment